Você pode alterar suas configurações de cookies através do seu navegador.

BONS NEGÓCIOS IMOBILIÁRIOS

BONS NEGÓCIOS IMOBILIÁRIOS

BONS NEGÓCIOS IMOBILIÁRIOS

BONS NEGÓCIOS IMOBILIÁRIOS

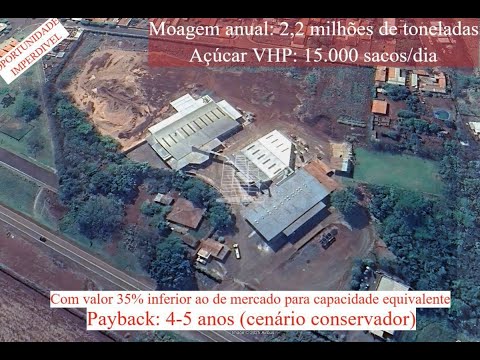

Ethanol and Sugar Mill, São Paulo, near Bauru, SP. Debt-free Environmental license up to date Crushing capacity: 2,200,000 tons Ethanol production: 550,000 liters per day VHP sugar production: 15,000 bags per day

Cadastre-se para ver as outras imagens

Descrição do Imóvel

Ethanol and Sugar Mill, São Paulo, near Bauru, SP

-

No debts

-

Environmental license up to date

-

Crushing capacity: 2,200,000 tons

-

Ethanol production: 550,000 liters per day

-

Sugar production: 15,000 VHP sugar bags per day

Strategic Investment Opportunity: Ethanol and Sugar Mill Ltd., Bauru/SP

-

Located in the state of São Paulo, 57 km from Bauru

-

Highly strategic and financially sound investment opportunity in the Brazilian sugar-energy sector

-

Completely debt-free and with regularized environmental license

-

Privileged location, robust production capacity, and modern infrastructure

-

High-value asset for international investors, especially traders, sugar exporters, and large rural producers

Operational Capacity and Infrastructure

-

Annual crushing: 2.2 million tons (maximum capacity), with a history of 1.85 million tons/year

-

Storage:

-

41 million liters of ethanol

-

800,000 VHP sugar bags (50 kg each)

-

-

Efficiency: 6 milling tandems of 66 inches, enabling continuous operation (except year-end recess)

-

Surplus energy: 10 MW available for sale, expandable to 50 MW with minimal investment

Financial Advantages and Valuation

-

Construction costs (benchmark): To build a mill with similar capacity today, the estimated cost is approximately USD 220 million (BRL 1.32 billion at the current exchange rate of BRL 6.00)

-

As the mill is used but annually refurbished and starts each season with almost new equipment, its value is estimated at about 70% of a new plant, i.e., USD 154 million (BRL 924 million)

-

Including industrial facilities, offices, laboratories, storage tanks, and other equipment, the total asset value reaches BRL 1.024 billion

-

With the mill at full operation, this value can increase by at least 35%, reaching over BRL 1.38 billion

-

Ethanol production, estimated at 90 liters per ton of cane, with an average price of BRL 3.50 per liter, can generate annual revenue of about BRL 693 million at full capacity

-

Possibility to acquire over 1 million tons of cane on the spot market for crushing in 2025, generating additional revenue of BRL 315 million

-

Simultaneous sugar production would further increase total revenue

| Component | New Cost (USD) | Current Cost (70%) |

|---|---|---|

| Crushing (2.2M t/year) | 220 million | 154 million |

| Industrial infrastructure | - | +100 million BRL |

| Total asset value | BRL 1.382 billion (+35% operational) |

Revenue Projection (full scenario):

-

Ethanol: 550,000 L/day × BRL 3.50/L = BRL 693 million/year

-

VHP Sugar: 15,000 bags/day × BRL 150/bag = BRL 821 million/year

-

Gross margin*: 40% sector average, potentially higher due to efficient logistics

Strategic Location

-

Logistics access:

-

Margin of Castelo Branco Highway (6 km from the duplicated section)

-

330 km from São Paulo (largest consumer center)

-

400 km from the Port of Santos (main export hub)

-

-

Competitive exemption: Only mill within a 70 km radius, with 40,000 hectares available for lease within a 40 km radius

Regulatory Context and Sustainability

-

Environmental licenses: Regularized (CETESB + water grants)

-

Difficulty of new authorizations: Severe restrictions on new projects in the state of São Paulo since 2020

Certifications

-

EPA USA (ethanol as advanced biofuel)

-

Eligible for RenovaBio credits (USD 25/t CO₂)

Global Market and Projections

-

International sugar price (ICE Futures): The Brazilian sugar and ethanol market is experiencing strong growth, with rising demand both domestically and for export

-

The Bauru region is the fourth largest ethanol producer in São Paulo, which accounts for more than half of national production

-

The mill can reach its maximum crushing capacity by the fifth harvest, benefiting from soil quality and strategic location

| Year | Average USD/ton | Variation |

|---|---|---|

| 2023 | 380 | - |

| 2024 | 420 | +10.5% |

| 2025* | 450 | +7.1% |

-

Ethanol demand (Brazil):

-

Flex-fuel fleet: 94% of light vehicles in 2025

-

E100 expansion: +12% consumption (2024-2025)

-

Exit Strategy and Return

-

Preferred acquisition model:

-

Estimated ROI: 22-25% per year (based on futures contracts until 2030)

-

Payback: 4-5 years (conservative scenario)

-

-

Appreciation factors:

-

Immediately available idle capacity (350,000 t/year)

-

Synergies with global traders: prior authorization for export to the USA

-

Operational Conclusion

-

The mill combines modern infrastructure, robust production capacity, strategic location, and regulatory compliance, making it an excellent investment opportunity

-

With assets valued at over BRL 1.38 billion in operation and industrial margins above 40%, the mill offers attractive financial returns and operational security

-

Easy access to raw material, expansion potential, and the current favorable environment in the Brazilian market make this asset especially relevant for international investors seeking exposure to the sugar-energy sector with controlled risk and high appreciation potential

Detalhes do Imóvel

- Metro

- Metro

Vídeos do Imóvel

Redes Sociais

Valores do Imóvel

|

$ 165.000.000

Valor de Venda

Valor do IPTU

$

10

|

Características do Imóvel

| Referência: | 4476 1140889 |

| Tipo de Imóvel: | Industrial » Agroindustria |

| Estágio do Imóvel: | Oportunidade |

| Última atualização do imóvel: | 18/08/2025 17:36:34 |

Localização do Imóvel

Principais Índices do Mercado Imobiliário Brasileiro

| Índices | Período | Valor |

|---|---|---|

| IGP-M | 9/2025 | 0,42% (2.83% acumulado) |

| INPC | 9/2025 | 0,52% |

| IPC-FIPE | 9/2025 | 0,65% |

| IPCA | 9/2025 | 0,48% |

| Índices | Período | Valor |

|---|---|---|

| IGP-M | 10/2025 | -0,36% (0.92% acumulado) |

| IPC-FIPE | 10/2025 | 0,27% |

| Índices | Período | Valor |

|---|